|

|

| 07-02-2024, 03:11 PM | #1 |

|

Major General

5918

Rep 5,512

Posts |

For those that retired early (early to mid-50s)?

I'm 50 and I'm aiming to retire by the time I'm 53. I've accomplished and learned most everything I can at my job and the grass wouldn't be greener elsewhere. 2 years ago I took a 20% pay cut and only work 32 hours now. I still have full benefits. My job to me is a way to obtain money to support my family and lifestyle. My job isn't my life and wouldn't shed a single tear if I could leave today. I do envy those that love their jobs and don't look at as I job, but that's not me. I like my own time, schedule, and I'm close to done dealing with needy and demanding clients, colleagues, office drama, and all the corporate "initiatives" and jargon.

My wife and I have done well for ourselves and I believe we have the funds for me to retire at around 53. My self-employed wife will continue to work as she loves her job though it doesn't bring in much at all. There is a good chance our daughter will play volleyball in college starting the fall of 2027 and we'd love to be available to go watch here play every match during her college years regardless of where they may be in the country. Our 19 y/o son will be graduated by the time she starts college. Both kids have fully funded 529s. With both kiddos out of the house, a less food costs, and no more club volleyball costs, etc. a decent amount of money will be freed up (I'm assuming around $1500-2000/mo freed up). Our house is paid off and we plan to downsize and hopefully buy a house that is about same in price or slightly more (less than $100K) than what our house will likely see for. We have no desire to buy other property, get a boat, take on new expensive hobbies, etc. My wife and I are healthy, fit, and no known current health issues. So the question for those that retired early, what additional/new expenses have been a surprise, unaccounted for, underestimated, etc.? I know health insurance will be very expensive prior to me being eligible for Medicare. Right now I pay about $450/mo for a high deductible family plan, vision, and dental. I'm expecting $1,100/mo for similar coverage if I retire at 53 with the dial increasing ~5-7% each year after year one.

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

| 07-02-2024, 04:23 PM | #2 |

|

Free Thinker

19067

Rep 7,532

Posts |

I didn't retire in my 50's, but I did retire at 62. I was in the same boat. My job was an income, nothing more. Because I took a pay cut to work closer to home, my highest paid years were behind me and my pension was based on those 4 highest years. After speaking with a retirement counselor, we determined that staying employed was not going to improve my retirement income much more than the 3% compounded raises my pension offers every year. So it didn't make financial sense to keep working. Wifey and I have long been nearly maxing out our supplemental retirement savings, so we have a good bit of money set aside to augment our pensions. Plus Wifey makes a shit ton more money that I ever did and she's 10 years younger and will keep working. Our house and cars are also paid off. We have no debts at all. We have no kids, so no expenses there. And our retirement plans include virtually free health care until we hit Medicare age (which I did this year).

The only expense that sort of caught me by surprise was Medicare Part B, which I had always thought was paid for by our retirement plan. That isn't the case. The plan pays for parts A, C, and D. Part B is deducted from the small Social Security benefit I get. But that was gravy money anyway, so it doesn't really affect our finances. Wifey doesn't have any Social Security benefits, so she'll have to pay Part B out of pocket when the time comes. The retirement plan medical coverage also has some deductibles and co-pays that are higher than I expected. But my total yearly out-of-pocket costs are capped at $1300, so it's not like there's a financial disaster waiting for me if my health goes south. That may be an issue for folks who don't have good supplemental coverage over and above Medicare. My folks paid a bundle for supplemental coverage, but it saved them when my Dad had heart surgery that went badly. His final hospital bill was over $2mil. Their total out-of-pocket cost in all that was a $600 ambulance ride. The supplemental plan covered the rest. So I'd advise anyone who retires to make sure you have rock solid medical insurance, as one bad incident can wipe out a lifetime of savings. I picked up the home automation bug after I retired and then drifted into playing with various security cameras. We don't really need them as we live in an extremely low crime area, but I found that experimenting and configuring cameras and the supporting network to be enjoyable. I'm a retired IT pro, so it keeps my mind in the game, so to speak. That hobby can get expensive, though. I also have $13k tied up in 2 bikes hanging on the wall of my garage and another $4k or so tied up in my "Pain Cave" with my trainer, bike, and rowing machine. But that is money well spent as it keeps me in shape. If you do retire early, make sure to keep busy. Between cycling and my hobby, plus the day to day stuff around the house and yard, I often find I don't have enough time in my days. It's a good problem to have.

__________________

|

|

Appreciate

6

vreihen1620124.50 2000cs3851.00 Murf the Surf20857.50 CamasM3e933659.50 T0RM3NT4522.00 Samurai of 2day2309.50 |

| 07-02-2024, 04:47 PM | #3 |

|

Brigadier General

9489

Rep 4,130

Posts |

I retired at 58 with no regrets. Mark makes great points on keeping busy/having hobbies. I found our medical insurance much more expensive that OP mentioned but our youngest is a type 1 diabetic so doing the math it was cheaper to pay the higher premium than taking the higher deductible and that has worked out as expected. That covers a family of four with two sons aged 23 and soon to be 25. Both will be off our insurance in a couple years so that expense will go down.

Between playing golf three times a week, yard work and house project the days are pretty full. We are fortunate to be in a good spot financially so it was the right choice for us. OP sounds like he's thought through this well but I watched my dad work until he was 75 (loved his work) but he really had no hobbies outside his career. With no hobbies etc he quickly declined after retiring at 75 and passed away at 77. Have a plan, think about your free time and how you'll spend it. You need activities, a good social circle, hobbies you enjoy, volunteer work to keep your mind and body busy.

__________________

2021 X3 M40i

1974 2002tii, Inka, 5 sp manual BMWCCA # 327475  |

|

Appreciate

4

|

| 07-02-2024, 05:37 PM | #4 | |

|

Colonel

7886

Rep 2,484

Posts Drives: 9Y0 Cayenne S Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

Travel expense (vacations). |

|

|

Appreciate

1

Murf the Surf20857.50 |

| 07-02-2024, 07:49 PM | #5 |

|

Captain

3851

Rep 1,003

Posts |

I retired sort of at 62. Had some consulting each year since, but I can pick and choose. I was a financial executive so that’s my focus for retirement planning.

Figure out a retirement budget, list all expenses and an “other” category to give you contingency. Monthly. Play with it, get confident. Then live with it, while still working, for a full year. Anything you don’t now have to pay for (health ins) but plan after retiring, put into savings during that year. During the year, monitor monthly and validate your plan. By the end of the year your plan will be pretty solid. Then add in allowance for infrequent discretionary spending (travel, graduation presents for kiddos, etc) and non-discretionary (major medical, whatever). At least an annual amount. Then test that against your savings, pension(s), and perhaps Social Security (assume full benefits and a significant haircut to stress test it). I like this little web bit for playing with assumptions https://engaging-data.com/will-money-last-retire-early/ Be sure to allow for inflation in your spending and significant declines in your investments. Once you get comfortable that you have the right budget and enough saved, pull the trigger. James Conole on YouTube has some very good videos on retirement planning (mostly financial but other issues as well). Good planning makes for excellent retirement living. Lots of ways to stay active, engaged, mentally (and physically) challenged, etc. |

|

Appreciate

4

|

| 07-02-2024, 07:52 PM | #6 |

|

Brigadier General

4824

Rep 3,611

Posts |

I retired in '94 at 45 and the wife in '97 at 50.

Because their future costs are so unpredictable, medical insurance and out-of-pocket costs are the key aspects of retirement expenses I would focus upon. The wife took care of all of that while we were working, after we retired, and up until she had a stroke. She'd clearly done a good job, as her 21 days in the ICU after the stroke resulted in an $1,880 bill. As the person doing the taxes, what I can say specifically about medical expenses is that we're still spending out-of-pocket around the same $15,000/year that we've always spent. This is clearly specific to the insured; for example, dental work now costs us remarkable sums and has us looking at Mexico and Costa Rica for alternatives. Despite the very high prices we can afford to pay for continuing dental care here in the States, we're asking ourselves the obvious question: "Why should we?"

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

| 07-03-2024, 07:47 AM | #7 |

|

Recovering Perfectionist

20125

Rep 999

Posts |

As someone in his very late 50's who is in day three of his involuntary retirement from working IT for the same employer for 38+ years, beating the boredom is my biggest challenge. I'm wrestling with a Raspberry Pi UPS shield that I plan to install for weather station logging at our tree farm down south, and already finished binge-watching most of the first season of "CHiPs" on Amazon Freevee.

My severely under-funded retirement account would love to hear thoughts on the 4% rule.....

__________________

Currently BMW-less.

|

|

Appreciate

0

|

| 07-03-2024, 01:26 PM | #8 | |

|

Brigadier General

4824

Rep 3,611

Posts |

Quote:

We take the required minimum distributions (RMD) from our IRAs each year, and those work out to roughly 4% of the accounts' values from the end of the preceding year. Maybe the IRS determined that a minimum annual withdrawal of ~4% was consistent with ensuring the IRA owner wouldn't run out of money if the RMD was all they took out each year?

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

|

|

Appreciate

1

vreihen1620124.50 |

| 07-03-2024, 02:22 PM | #9 |

|

Recovering Perfectionist

20125

Rep 999

Posts |

My assumption was that 4% was some sort of long-term average for stock market growth, so a retiree could safely take that much out and never touch their balance.

One of my 403(b) investment options is a thingy with a guaranteed 4% for my life. They must believe that whatever I put into that fund will last forever. The bad thing is that it is only for *my* life, and my younger and much healthier DW would get nothing after I die from boredom in a few months if I chose that option.....

__________________

Currently BMW-less.

|

|

Appreciate

0

|

| 07-03-2024, 02:32 PM | #10 | |

|

Captain

3851

Rep 1,003

Posts |

Quote:

By the way, RMDs don’t have to be spent. They can be invested in a conventional brokerage account, after paying the tax of course. |

|

| 07-03-2024, 02:34 PM | #11 | |

|

Captain

3851

Rep 1,003

Posts |

Quote:

|

|

|

Appreciate

1

chassis7885.50 |

| 07-03-2024, 02:52 PM | #12 |

|

Major General

5322

Rep 5,662

Posts |

I got age-retired almost 12 years ago. Should have succumbed to "controllers disease" (widow-maker w/100% blockage in my left main artery; DR says no medical reason I was still alive) just over 6 years ago. I've found that it takes me longer to do anything ("unlimited" time and all); I was going to clean out my garage, still not done; going to clean out my desk, about half done; took me 4 months to do a project that would normally take a weekend. After 34 years of shift work, I'm finally getting into a "normal" sleep/wake schedule, though I'm not above taking a nice nap

. There are times I'd like to go back to work in the training dept. or work at a contract tower, but we now have babysitting duties for our grandkids. THAT is the best job there is! Oddly, even with about a 33% pay cut, our lifestyle hasn't changed much. Gummint shutdowns don't affect me as retirement checks are the first checks the gummint issues; I always get paid, no matter what. It's amazing how much we have saved in gas not driving 55ish miles, 5 days a week. . There are times I'd like to go back to work in the training dept. or work at a contract tower, but we now have babysitting duties for our grandkids. THAT is the best job there is! Oddly, even with about a 33% pay cut, our lifestyle hasn't changed much. Gummint shutdowns don't affect me as retirement checks are the first checks the gummint issues; I always get paid, no matter what. It's amazing how much we have saved in gas not driving 55ish miles, 5 days a week. |

|

Appreciate

5

|

| 07-03-2024, 04:06 PM | #13 |

|

Major General

5918

Rep 5,512

Posts |

Thank you all for the replies. It's very helpful.

I have used the attached "Rich, Broke, or Dead" website (https://engaging-data.com/will-money-last-retire-early/) and with inputting our savings without including our paid off home and having annual spending at an unrealistically high level (basically more than we're spending with kids), it says we have a 100% success rate with a 4.3% withdrawal rate and me living to 83 (doubt it). The likelihood is high that at age 83, our portfolio would be worth more or twice it's current value. I'm not accounting for inheritance either. My 79 y/o mother has no debt and a very home and solid portfolio plus supplemental insurance, but she's in poor health and you just never know what that money may need to be used for. I totally agree that supplemental health insurance is must. My 70 y/o father's medical expense bills totaled close to $1M after a failed heart valve surgery. 13 days in the ICU plus the surgery and very intensive care is expensive. He passed away from that ordeal. Luckily all my mother had to pay was $1K out of pocket. Pretty nuts and thank God. Agreed on the hobbies too. I like doing athletic stuff and I play volleyball 4 to 6 hours a week. I also work on cars, ride bikes, work out, etc. Once retired, I want to play more volleyball and also be a mechanics coach for 12 to 17 y/o volleyball players. I won't make much money doing it, but it would be fun to help these players.

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

|

Appreciate

4

|

| 07-04-2024, 08:28 AM | #14 |

|

Lieutenant

369

Rep 438

Posts |

A couple of things come to mind, and I didn’t fully understand and plan for them. They just weren’t that important when I was younger.

If some of your income is from rental property, and you plan to sell it to fund your retirement, the income tax exemptions for seniors selling their home do not apply. It is a business property, so you pay tax on the direct profit, and on the depreciation recovery. That increase in income may also cause you to not qualify for other programs that are tied to income. You can usually avoid the income tax by moving into the property for at least 2 years, or rolling it over to another income property (Starker exchange), but that does not put retirement money in your pocket. Medicare is mandatory, and premiums depend on your income two years prior. If you sold a property or pulled a bunch out of our IRA to buy your retirement house, it raises your income and your Medicare premium. Your Medicare premium could go from $175/month base up to as high as $594/month. That is a per person cost, so double it for a couple. If you have a lot of money in IRAs or your 401k, the required minimum distributions at age 73 could hit you hard. You are force to take it out unless you pay a very high penalty. It increases your income that year, so your Medicare premiums also go up. Take a look at making Roth conversion, if you are eligible. It is painful up front, but in the long run can be a very good deal because withdrawals are not taxed, and there is no RMD. Any tax deferred account you pass on to your children or other family will be taxed when withdrawn, and there is a limit to how long they can leave it in the IRA or 401k. You are passing on funds, but also passing on the tax burden. |

|

Appreciate

5

|

| 07-04-2024, 11:11 AM | #15 |

|

First Lieutenant

5304

Rep 387

Posts Drives: GMC Denali Join Date: Feb 2021

Location: Missouri

|

Talk to a financial planner that can help you navigate your specific situation. Listening to what everyone else has done likely won't amount to much of a benefit for you. My wife retired three years ago and is taking regular withdrawals and her retirement savings is worth more now than when she first retired. Looking at my plan, I'll be able to pull more out than I currently take home and will, assuming no major depressions, have seven figures in remaining funds at age 93. I will work until I turn 60 and call it done at that time. I'll have five years of stupid medical insurance premiums before I am eligible for Medicare, but that is all factored into the plan my financial planner and I put together.

|

|

Appreciate

3

|

| 07-04-2024, 11:16 AM | #16 | |

|

Captain

3851

Rep 1,003

Posts |

Quote:

If you have one good year you can appeal a Medicare premium increase by showing you have lower income and explain it. Might win, might not, but worth trying. You can start withdrawing from a IRA or 401(k) much before the age where you have to take RMDs. This allows you to bleed those accounts down and put the funds you don’t need to live on into a regular account. One strategy would be to invest in growth stocks/funds in the regular account so any income there would be capital gains (lower taxes) and the withdrawals then kept just below a tax bracket point (ie within the 15% bracket). If SS is deferred as well, you can manage the taxes during your 60s and set up for lower taxes in your 70s and beyond. If you have these more complicated situations, a good financial planner or CPA should be consulted. |

|

|

Appreciate

1

CamasM3e933659.50 |

| 07-09-2024, 09:05 AM | #17 | |

|

Major

1548

Rep 1,491

Posts |

Quote:

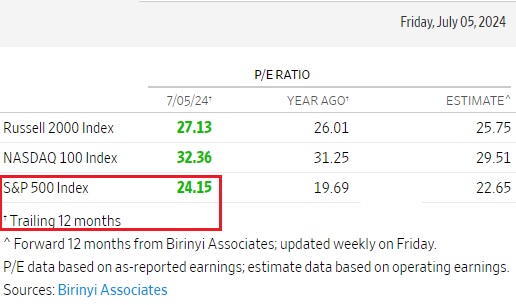

T Rowe Price: Formula to withdraw money from a S&P mutual fund account. Cheap - S&P trading at 10 times trailing 12 month earnings with balanced portfolio can withdraw as much as 6.8% per year. Pricey - S&P trading at greater than 17.4 times trailing 12 month earnings a more prudent rate of withdrawal would be 3.9% per year. |

|

|

Appreciate

1

vreihen1620124.50 |

| 07-09-2024, 12:10 PM | #18 | |

|

Brigadier General

4824

Rep 3,611

Posts |

Quote:

__________________

2017 M240i: 25.9K, 28.9 mpg, MT, Sunroof Delete, 3,432#, EB, Leather, Driving Assistance Package, Heated Front Seats | Sold: E12 530i, E24 M635CSi, E39 520i, E30 325is, E36 M3 (2)

TC Kline Coilovers; H&R Front Bar; Wavetrac; Al Subframe Bushings; 18X9/9½ ARC-8s; 255/35-18 PS4S (4); Dinan Elite V2 & CAI; MPerf Orange BBK; Schroth Quick Fit Pro; Full PPF |

|

|

Appreciate

0

|

| 07-12-2024, 12:02 PM | #19 |

|

Colonel

4167

Rep 2,942

Posts |

Solid medical insurance (affordable deductibles, no cap on payouts) is very important - as we get older, the potential for multi-million dollar treatment episodes goes way up. It is also worthwhile to explore setting up a trust for assets to protect them from medical bills or medicare spend-downs.

|

|

Appreciate

0

|

| 07-12-2024, 12:29 PM | #20 |

|

Recovering Perfectionist

20125

Rep 999

Posts |

Week #2 of my involuntary early retirement has been spent locked in the bedroom at home, trying to avoid catching COVID from my prettier half and OCD typhoid dog. Boredom after almost 39 years working in IT? I just reported two Github repositories that I stumbled on to their abuse department, one for serving pirated magazines to Chinese readers and the other for SEO spam articles. I'm sure that I'll be chasing birds off the lawn by next week.....

__________________

Currently BMW-less.

|

|

Appreciate

4

|

| 07-12-2024, 01:42 PM | #21 | |

|

Free Thinker

19067

Rep 7,532

Posts |

Quote:

__________________

|

|

|

Appreciate

3

|

| 07-13-2024, 09:13 PM | #22 |

|

Major

1548

Rep 1,491

Posts |

|

Post Reply |

| Bookmarks |

|

|