|

|

| 08-19-2016, 09:04 AM | #8097 | |

|

Banned

7929

Rep 1,923

Posts |

Quote:

Basically, I have no problem with an educated, preferably younger (ie 30's) investor borrowing to invest in an asset (whether that be the market, real estate, etc), but it is a gamble so they have to be educated on the risks. Somewhat similar to a casino, though the odds aren't stacked quite as high against you, but its not a sure thing. So it's good to be on the younger side so you can pay off the debts if it goes south and still have a chance to gather enough assets to retire on later. But if you are too young (ie not educated enough / impulsive) or too old (ie. the risk might be too high given you wish to retire), I'd probably advise against it. When you think about it, we all sort of use leverage in some form or another usually. Most people need a mortgage when purchasing a house - I would argue that is a form of leverage. Normally a good kind, as you can only create more land in very limited scenarios, otherwise, land is pretty fixed and so there will generally be a value there. On the other hand, you have a car loan - which is a poor form of leverage as it is often a depreciating asset. |

|

|

Appreciate

0

|

| 08-19-2016, 09:10 AM | #8098 |

|

Lieutenant

2785

Rep 421

Posts |

Until BMWFS comes out with .9% car loans and you're like damn, sign me up.

|

|

Appreciate

0

|

| 08-19-2016, 09:40 AM | #8099 | |

|

Banned

7929

Rep 1,923

Posts |

Quote:

I'm curious - what are your thoughts on negative interest rates - think we'll see them in the next few years? They've been yanking that lever for the past number of years and it hasn't done what people thought it would do...time for a switch in tactics. I'm a little worried, but I still have some faith that someone somewhere has a little common sense left. Terrible thing about that - common sense these days might be more aptly named rare sense. |

|

|

Appreciate

0

|

| 08-19-2016, 09:44 AM | #8100 | |

|

Lieutenant

2785

Rep 421

Posts |

Quote:

Not a fan. Not a fan of central bank intervention. Not a fan of central banking. Don't want to get into it, but will refer to one of my favorite Hayek quotes... "the curious task of economics is to demonstrate how little we really know about what we imagine we can design." |

|

|

Appreciate

0

|

| 08-19-2016, 09:47 AM | #8101 |

|

Know's a guy that know's a guy...

5637

Rep 1,905

Posts |

Joekerr - I meant what I wrote.

Let's say you have a R/E investor we typically call 'R/E rich and cash poor'. Where they maintain a low leverage (or DEBT) position on R/E assets that provide a steady and stable monthly income stream; however another opportunity arises to acquire additional property but they lack the cash equity injection necessary to acquire the property at the appropriate LTV. They want to fund their portion of the equity toward the transaction using available equity from existing R/E assets that can support the increased debt due to their current favorable debt (or LEVERAGE) position on said R/E asset. Hopefully I have better articulated the phrase '...funding equity from debt'.

__________________

Last edited by ASBSECU E93; 08-19-2016 at 09:58 AM.. |

|

Appreciate

0

|

| 08-19-2016, 10:06 AM | #8102 |

|

fight me bro

2212

Rep 531

Posts |

I like pussy

|

|

Appreciate

6

Aatish3458.00 The Choosey begger71933.50 ///M Power-Belgium63364.00 Mr.SugarSkulls2889.00 Dang3r12512.00 1LRM3516.50 |

| 08-19-2016, 10:07 AM | #8103 |

|

Lieutenant

2785

Rep 421

Posts |

There he is! What a good little Smooshy, yes you are, yes you are!

|

| 08-19-2016, 10:19 AM | #8104 | |

|

Banned

7929

Rep 1,923

Posts |

Quote:

Provided the market remains strong, it's a good move if you feel the property is undervalued / under-tenanted and you can bring something different to the table to bring up the cash flows in that property, such that you can get back to cash flow positive. I admit I've considered this strategy myself, though I then learned something about myself - I don't have that kind of risk tolerance. I just can't pull the trigger. At least not right now - I have too much else on my plate to take on that exposure. But I know a few guys that are applying what you wrote above, and thus far, they are doing very well. Provided things continue to remain strong, they should also continue to do very well. One consideration point: Interest rates have never been this low. I think you have to ask yourself the question - will the people in charge grow a set and raise the rates, take the pain that it will cause for the ultimate benefit to the economy OR will they never raise rates for fear of getting kicked out / what it will do short term to the economy. Once you have the answer to what you believe will happen, I think that helps dictate your course of action. There is a lot of businesses out there that I believe are bad businesses and are only surviving because money is almost free right now from an interest perspective. If rates go up, these over-extended businesses will fail, and the economy will hurt. Tenants will vacate, commercial (and likely residential) property prices will fall - at least in the short term. Do you have the resources to weather that time period? If that were to occur next year, would the building being acquired still be a good value today? On the other hand, if you think that nobody will ever do anything and banks will continue to meddle and keep interest rates low, then absent other factors, demand will likely stay strong. And it could be a very good investment. Gaze into that crystal ball and tell me what you see. That's all any of us can do. |

|

|

Appreciate

0

|

| 08-19-2016, 10:29 AM | #8105 |

|

Know's a guy that know's a guy...

5637

Rep 1,905

Posts |

I'm never a fan of the scenario I've described because the lender assumes 100% of the risk in every loan transaction, but a combination of present factors can lead to some interesting opportunities as you describe.

Ideally, and with respect to CRE, long term leases on CRE with nationally debt rated companies are typically solid, even in down economic times. Grocery chains (Publix), Walgreens, Verizon Stores, GSA, etc...all safe bets for the next 10 years. ESPECIALLY if these can be moved into the permanent market non-recourse! Where you'd get hung out to dry - Circuit City type event where. I know a couple people who were hit hard holding a larger CRE position than optimal. What line of business are you in? Finance? |

|

Appreciate

0

|

| 08-19-2016, 10:34 AM | #8108 | |

|

Lofty

3458

Rep 849

Posts |

Quote:

__________________

F30 335 (FBO and BM3 OG)

991.2 C2 Range Rover Sport Diesel I4 M50 (coming soon) |

|

|

Appreciate

0

|

| 08-19-2016, 11:21 AM | #8109 | |

|

Banned

7929

Rep 1,923

Posts |

Quote:

|

|

|

Appreciate

1

Biorin2784.50 |

| 08-19-2016, 11:24 AM | #8110 |

|

Lieutenant

2785

Rep 421

Posts |

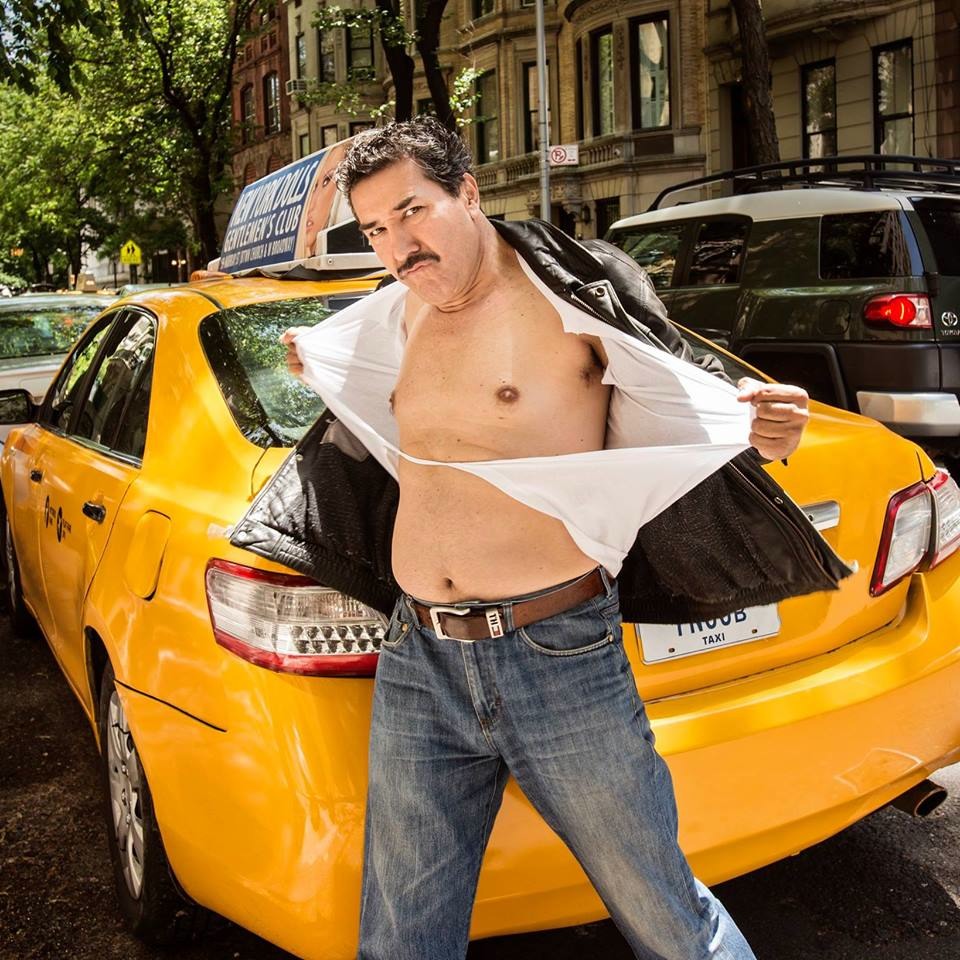

Pfft, lowly, hold your head high! #taxissexy (yes, that was actually a [not very successful] hashtag trend)

|

|

Appreciate

0

|

| 08-19-2016, 11:27 AM | #8111 |

|

Banned

7929

Rep 1,923

Posts |

|

|

Appreciate

0

|

| 08-19-2016, 11:28 AM | #8112 | ||

|

Know's a guy that know's a guy...

5637

Rep 1,905

Posts |

Quote:

You spend days coloring INSIDE the lines whereas I have the freedom to color where ever  |

||

|

Appreciate

0

|

| 08-19-2016, 11:29 AM | #8113 | |

|

Lieutenant

2785

Rep 421

Posts |

Quote:

|

|

|

Appreciate

4

|

| 08-19-2016, 11:33 AM | #8114 |

|

Banned

7929

Rep 1,923

Posts |

|

|

Appreciate

0

|

| 08-19-2016, 11:36 AM | #8115 | |

|

Know's a guy that know's a guy...

5637

Rep 1,905

Posts |

Quote:

Primary responsibility is Commercial lending with other functional areas of company operations just for shits and giggles. Basically - you tell people how much they owe....I tell them how much they can borrow  |

|

|

Appreciate

0

|

| 08-19-2016, 11:47 AM | #8117 | |

|

Banned

7929

Rep 1,923

Posts |

Quote:

And any little doodles across the line are quickly erased from what I've heard. Permanently.  |

|

|

Appreciate

0

|

| 08-19-2016, 11:54 AM | #8118 |

|

Schmollbraten

12512

Rep 1,985

Posts |

Afaik you must have additionally a fuqbook account to use tinder, no? Thats a double pwnage...

__________________

Citizen of ///M - Town, where too much is just right Some say, that my scrotum has its own small gravity field and when Im slowing down that brake lights come on at my buttox  |

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|