|

|

| 07-18-2012, 04:11 PM | #89 | |

|

Banned

707

Rep 1,908

Posts |

2009 Article

Quote:

|

|

|

Appreciate

0

|

| 07-18-2012, 04:15 PM | #90 | |

|

Lieutenant

67

Rep 549

Posts |

Quote:

|

|

|

Appreciate

0

|

| 07-18-2012, 04:18 PM | #91 | |

|

Banned

707

Rep 1,908

Posts |

Quote:

Well...now you really are on crack, because interest rates are the lowest they've been in years and there are tons of foreclosed, for sale homes on the market with banks carrying the expenses such as property tax etc. These home need to be unloaded. Do you have any clue what you're talking about? :lol "Recently" Oh, so how does that show a trend or how does that paint a picture of how these foreclosure layout? Also, the funny criticism you have about these loans is, the implication ignoring those people have to actually qualify. You're implying anyone can get it that why the delinquency rate is higher. I think you're way too emotional. I think you're so emotional, you'd rather be difficult than actually admit that having funds in the bank is a better option. That's not common sense. But, hey! Stick to your guns. |

|

|

Appreciate

0

|

| 07-18-2012, 04:19 PM | #92 | |

|

There is No Substitute

74

Rep 1,186

Posts |

Quote:

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  |

|

|

Appreciate

0

|

| 07-18-2012, 04:20 PM | #95 | |

|

Lieutenant

100

Rep 460

Posts |

Quote:

|

|

|

Appreciate

0

|

| 07-18-2012, 04:22 PM | #96 |

|

Banned

707

Rep 1,908

Posts |

|

|

Appreciate

0

|

| 07-18-2012, 04:35 PM | #97 | ||

|

There is No Substitute

74

Rep 1,186

Posts |

Quote:

Quote:

Also, your article is from 2009. Good luck getting financed at 5% from a private lending institution in 2012.

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  |

||

|

Appreciate

0

|

| 07-18-2012, 05:34 PM | #98 |

|

Captain

159

Rep 709

Posts |

in that article it says a 720 score is very good but that was in 2009. How about in todays standards. Mine is about 720 as of today because in the past 12 months I've had over 10 Inquiries. All my debts will be paid off by the end of the year and my credit report activity will be dormant until early 2013. I'm 36 with 3 dependents with a net of 80k/year. I have enough for 20% DP on a $200k house but I don't want to if i don't have to. Am I approved?

__________________

|

|

Appreciate

0

|

| 07-18-2012, 05:55 PM | #99 | |

|

Lieutenant

67

Rep 549

Posts |

Quote:

I had barely over a 750 when I bought, and was warned that if I dropped to a 749 before closing the rate would go up. This was Nov 2011. |

|

|

Appreciate

0

|

| 07-18-2012, 06:08 PM | #100 |

|

Captain

159

Rep 709

Posts |

That's what I'm afraid of. i might just wait a little longer to buy. that way i can save up some more and hope the market don't pick up anytime soon. What do you think the market will look like next year or so. After Romney becomes president..

__________________

|

|

Appreciate

0

|

| 07-18-2012, 06:34 PM | #101 | |

|

Private First Class

16

Rep 158

Posts |

Quote:

On our purchase contracts there are boxes to be checked indicating who pays for what. I presumed all states had similar boxes. Curious to know if that is the case now. |

|

|

Appreciate

0

|

| 07-18-2012, 06:54 PM | #102 |

|

Registered

4

Rep 4

Posts |

all you need to get aprove is 630 for FHA..bank is 700

all the articles you guys are quoting is 6 months behind... i do this for a living- i'm on the frontline of this real estate stuffs.... all the people saying that putting 20% down are real dumb (consumers), they dont know anything with real estate and finances...... putting 20%-30% down means that you think you are going to live in that house forever unit pay it off.....

let me tell you something, a house is a tool that you use and change, upgrade, move, and etc..... you are not your parents that buys and stay there forever.... this generation, a house is live in 3-5 years....why would you put down lots of $$$ and not have a rainy day backup $$$..... |

|

Appreciate

0

|

| 07-18-2012, 07:13 PM | #103 | |

|

Captain

159

Rep 709

Posts |

Quote:

__________________

|

|

|

Appreciate

0

|

| 07-18-2012, 07:16 PM | #104 | |

|

Banned

707

Rep 1,908

Posts |

Quote:

Actually, that article touches on every single point I made. Definition: Private mortgage insurance, often referred to as PMI, is insurance that lenders require borrowers to pay for when they get a mortgage and don’t have enough equity in the home. http://financialplan.about.com/od/re...minate-PMI.htm -On post #45, I said a PMI is levied by the lender on a homeowner who doesn't put 20% down to offset the lack of equity in the home. It's the lender's insurance per se to protect them. Once enough equity is reached the PMI ceases, thereby lowering their mortgage payment anyway. YOU SAID OTHERWISE and you're wrong! -Initially, you argued the 20% rule. I said otherwise considering our current economic climate. The article, if you want to reference that, detailed in plain view, how qualifying for an FHA loan with less down actually can yield a lower interest rate than a conventional loan. And that banks often see large down payments as riskier since much of their emergency funds are depleted. YOU SAID OTHERWISE and you're wrong! -The article said one should maintain several months of mortgage payments, I have championed that same advice since I entered this thread and advised those to save some of that large down payment in the event of an emergency. -The article you posted mentioned Freddie Mac and Fannie Mae, no? Well, the article I posted quoted a spokeswoman for Fannie Mae and she herself said those who put down 20-25% are the RISKIEST to lenders. How could that be? Well, they don't carry a PMI. So, that little fact completely destroys your very poor advice you're giving to people on this site, buddy. BTW, I have a 3.3. So, have no idea what the heck you're talking about but, then again you think it's not a good time to purchase a home, so what do I know.... |

|

|

Appreciate

0

|

| 07-18-2012, 07:48 PM | #105 | |

|

Lieutenant

67

Rep 549

Posts |

Quote:

I put 20% down and have more than another 20% for a rainy day. Does that still make me "real dumb"? Does that mean I "don't know anything about real estate and finances"? Real estate isn't a business for everyone. My home isn't a "tool". It's my home. |

|

|

Appreciate

0

|

| 07-18-2012, 08:38 PM | #106 |

|

Registered

4

Rep 4

Posts |

you are just a consumer- thats all you know

consumers only know to spend $$$, they dont know how to keep or make big money.... take away the your job and things fall apart.... businessmen knows when to put out money and when to keep the money. I'm trying to tell you how to work the system, not be the system....

|

|

Appreciate

0

|

| 07-18-2012, 08:48 PM | #107 | |

|

There is No Substitute

74

Rep 1,186

Posts |

Quote:

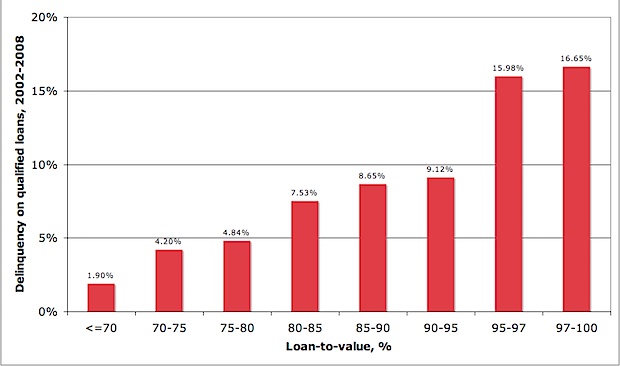

Here's actual statistics showing delinquencies by down payment amount:   From 2002-2008, people who put down 3% were FOUR times likely to default than people who put down 25%. These are actual delinquency statistics recorded by the mortgage industry. All lower down payments does is increase the size of the market, but in doing so it raises the rate of default. This is statistical fact, not opinion. As I said before, your advice is horrible.

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  Last edited by MediaArtist; 07-18-2012 at 09:01 PM.. |

|

|

Appreciate

0

|

| 07-18-2012, 08:59 PM | #108 |

|

Banned

707

Rep 1,908

Posts |

How about you address all of the fallacies you are promoting in this thread and give the graphics a break, huh? I addressed everything you spewed yet you can't

rebut any of it. I call that being intellectually dishonest. I'll give you a second chance instead of dodging my clear points. |

|

Appreciate

0

|

| 07-18-2012, 09:10 PM | #109 | ||

|

There is No Substitute

74

Rep 1,186

Posts |

Quote:

Quote:

The lowest FHA rate as of 7/18/12 can offer for a 30 year fixed is: 3.791% The lowest conventional 30 year fixed is: 3.673% When you go 15 year fixed it gets even worse, FHA: 3.433%, Conventional: 3.091% So basically, your advice is based on an outdated faulty premise. I think the only "clear" point here is that your advice is horrible. Now why don't you address the fact that lower down payments (like you're suggesting) lead to higher rates of default?  In fact, I know you can't answer it, so let's try something you will understand. Why don't we have a gentleman's bet to settle this issue? Let's say a small amount of $1,000. I'll bet you that FHA delinquency will rise in the next 3 months, because low down payment financing, and a system based on it, simply doesn't work. So by October 18th, 2012 (or so), I will bet you $1,000 that FHA delinquency will rise, rather than go lower. If what you're saying is true, that low down payments work, you should take my $1,000 without much effort. If however delinquency does rise (anything above a 0% increase), then you owe me $1,000. We can have a moderator hold the checks, or do donations to our favorite non-profit. Are you game?

__________________

'13 Audi A6

'07 Porsche GT3 RS '08 BMW E90 335i  Last edited by MediaArtist; 07-18-2012 at 09:21 PM.. |

||

|

Appreciate

0

|

| 07-18-2012, 09:38 PM | #110 |

|

Captain

159

Rep 709

Posts |

It makes sense that for people who put lower DPs it's easier for them to walk away if shit hits the fan vs. someone who's invested more money for their home. I think we all get that..

__________________

|

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|