|

|

| 12-04-2019, 04:05 PM | #89 | |

|

OPN DIFF

494

Rep 1,918

Posts Drives: 10' E90 M3 6MT LB Join Date: Oct 2012

Location: Pacific Ocean

|

Quote:

__________________

'10 LB E90 slicktop/speed cloth/6MT ex. '06 330i 6MT & '10 n54 6MT Msport Autocross vids https://www.youtube.com/user/tigermack https://www.instagram.com/tigermack |

|

|

Appreciate

0

|

| 12-05-2019, 12:18 PM | #90 | |

|

Colonel

8203

Rep 2,250

Posts |

Quote:

__________________

Everybody has a gameplan....until they get punched in the mouth.

|

|

|

Appreciate

0

|

| 12-05-2019, 02:36 PM | #92 |

|

First Lieutenant

275

Rep 305

Posts Drives: BMW M235i Join Date: Jun 2019

Location: Seattle, WA

|

I'd recommend maxing out at $19000 if you can, unless your company has poor and costly fund options. Especially if it will drop you to a lower tax bracket.

Last edited by grocerylist; 12-05-2019 at 02:47 PM.. |

| 12-05-2019, 03:05 PM | #93 | |

|

Major General

3069

Rep 6,089

Posts |

Quote:

|

|

| 12-05-2019, 04:50 PM | #94 |

|

Captain

1718

Rep 618

Posts |

I max everything: pre-tax 401k, catch up 401k, after tax 401k (which I rollover to a Roth every year), and 2 traditional IRA's + catchup that I then roll to a Roth every year.

|

|

Appreciate

1

Rmtt8203.00 |

| 12-05-2019, 05:44 PM | #95 | |

|

dances with roads

5075

Rep 4,130

Posts |

Quote:

|

|

|

Appreciate

0

|

| 12-05-2019, 05:52 PM | #96 | |

|

Major General

3069

Rep 6,089

Posts |

Quote:

|

|

|

Appreciate

0

|

| 12-06-2019, 04:18 AM | #97 |

|

2JZ-GTE

3166

Rep 4,138

Posts |

Boeing

|

|

Appreciate

0

|

| 12-06-2019, 07:56 AM | #98 | |

|

Captain

1718

Rep 618

Posts |

Quote:

|

|

|

Appreciate

0

|

| 12-06-2019, 09:57 AM | #99 | ||

|

Major General

3069

Rep 6,089

Posts |

Quote:

|

||

|

Appreciate

0

|

| 12-06-2019, 11:17 AM | #100 | ||

|

Major

1650

Rep 1,011

Posts |

Quote:

|

||

|

Appreciate

0

|

| 12-06-2019, 12:33 PM | #101 | |

|

Major General

5944

Rep 5,527

Posts |

Quote:

- Then take other money and open a Roth IRA. Again, buy mostly low expense ratio/fee S&P 500 index funds. - Then once those accounts are cranking and have 6 figures in them, then open a brokerage account and buy more low expense ratio/fee S&P 500 index funds, quality stocks and funds, and play around. - Pay off your house. Do all of this while living within your means and don't be a slave to debt or buy into the YOLO idea because the reality is you're likely living into your 70s or later.

__________________

The forest was shrinking, but the Trees kept voting for the Axe, for the Axe was clever and convinced the Trees that because his handle was made of wood, he was one of them.

|

|

|

Appreciate

2

damageprone581.50 Rmtt8203.00 |

| 02-27-2020, 10:25 PM | #102 | |

|

Second Lieutenant

81

Rep 232

Posts |

Quote:

|

|

|

Appreciate

0

|

| 02-28-2020, 09:01 AM | #103 |

|

M3

1435

Rep 725

Posts |

With the exception of the 401K I have through my employer and my wife's Vanguard account, I liquidated my Schwab brokerage and put all of the money into a CD at 2.55% for 12 months back in October. Impeachment, the coming election cycle and an unsubstantiated belief that the market was "due" for a correction drove my decision making. I figured the volatility could or would limit the potential upside in the stock market.

Even without factoring in the coronavirus drop, in hindsight, now that I see the trajectory the election cycle is taking in the Democratic Party, I'm happy I got out. Come October, I think I will be in a better position on where to invest vs. where I was last October, that's the hope at least. For now, I'm happy to keep up with inflation. |

|

Appreciate

0

|

| 02-28-2020, 11:09 AM | #104 |

|

Lieutenant

620

Rep 442

Posts |

Shorting futures is quite lucrative at the moment.

__________________

2014 335i 6MT /// Mineral Gray - Red Coral

| M Perf Spoiler | M Perf Lip & Diffuser | M Perf Grilles | M Perf Side Splitters | M Perf CF & Alcantra Interior Trim | | Wagner Evo II FMIC | VRSF DP | AA CP | CTS Turbo Intake | MHD Stage 2 Tune | H&R Sports | Bilstein B8s | |

|

Appreciate

1

3GFX717.00 |

| 02-28-2020, 11:34 AM | #105 |

|

Banned

859

Rep 407

Posts Drives: Miss Daisy Join Date: Jul 2019

Location: PA

|

|

|

Appreciate

0

|

| 02-28-2020, 11:58 AM | #106 |

|

Captain

1718

Rep 618

Posts |

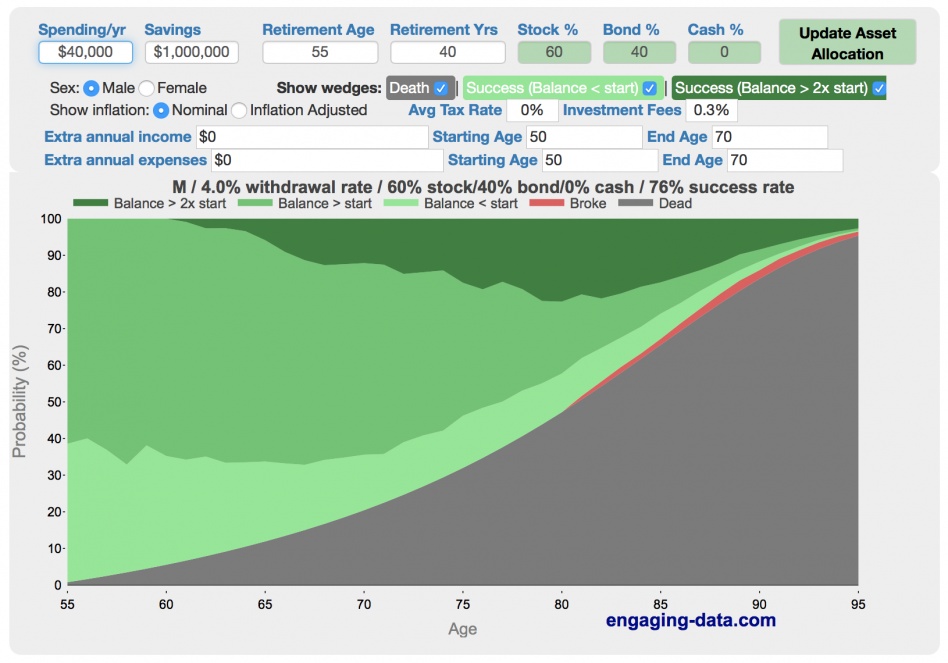

This is my favorite chart. It helps me focus on living today vs. planning for tomorrow.

Here's link if you want to play with it: https://engaging-data.com/will-money...5x=1&flexpct=0

__________________

stultorum criminis reus erit

|

|

Appreciate

5

|

| 02-28-2020, 09:53 PM | #108 | |

|

Colonel

8055

Rep 2,498

Posts Drives: 9Y0 Cayenne S Join Date: Mar 2019

Location: Einbahnstraße

|

Quote:

|

|

|

Appreciate

0

|

| 03-02-2020, 02:05 PM | #109 |

|

Lieutenant Colonel

13072

Rep 1,965

Posts |

currently I would invest in surgical masks, later - toilet paper.....then I would put it deep inside my hot ass girlfriend. Next.

|

|

Appreciate

0

|

| 03-02-2020, 10:36 PM | #110 |

|

Banned

3227

Rep 2,385

Posts |

|

|

Appreciate

2

King Rudi13072.00 Jordan's World429.00 |

Post Reply |

| Bookmarks |

|

|