|

|

| 01-18-2012, 02:00 AM | #2509 | ||

|

Private First Class

275

Rep 123

Posts |

Quote:

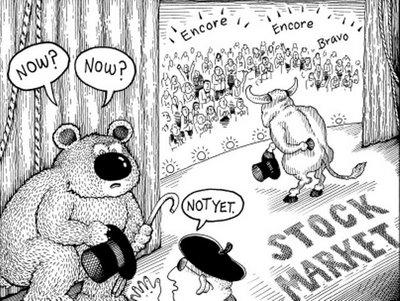

Couldn't help but put this picture up:   Quote:

__________________

|

||

|

Appreciate

0

|

| 01-18-2012, 05:24 PM | #2510 |

|

Major

55

Rep 1,166

Posts |

Man, I'm shocked by how blunt they wrote that in the fine print. But that's how penny stock pushers usually operate. Like sleezballs

[/QUOTE] [/QUOTE]those sleezballs must be doing a good job  it shot up almost 32% today alone it shot up almost 32% today alone

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

Appreciate

0

|

| 01-18-2012, 05:48 PM | #2511 |

|

Lieutenant

140

Rep 419

Posts |

My friend told me to buy NSRS but I typical try to stay away from pump and dump stock. The return is crazy though...

|

|

Appreciate

0

|

| 01-18-2012, 08:32 PM | #2512 | |

|

Major

55

Rep 1,166

Posts |

Quote:

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

|

Appreciate

0

|

| 01-19-2012, 01:43 PM | #2514 |

|

Captain

126

Rep 876

Posts |

here is something funny to consider, watch SPX when it touches 1330 as predicted here many months ago, it should drop from there...funnier thing to consider is this, some news will come right at that point and the street will say the drop was due to this bad news(ie-Greece going to default surprise surprise).

Charts usurp news not other way around. |

|

Appreciate

0

|

| 01-19-2012, 01:52 PM | #2515 | |

|

Private First Class

275

Rep 123

Posts |

Quote:

Bulls broke 1300 on SPX and everyone is still on the sidelines. Light volume

__________________

|

|

|

Appreciate

0

|

| 01-19-2012, 02:01 PM | #2516 |

|

Lieutenant

646

Rep 568

Posts |

I've been a long time lurker here of the OT forum (well over 4 years) so please don't mind me. What evidences do you have that point to us hitting 1330? Prior to today, I saw a classic three push up forming but this renewed strength today has me going the other direction of the ST. I've been calling out a top for some time now and I still believe it is close but if we were to hit 1330, it would be a different story. We will know tomorrow if we see a pull back whether or not the top was in. Thankfully, I never front run the market so I'm sitting right now holding long and short trapped positions in SSO and SDS.

|

|

Appreciate

0

|

| 01-19-2012, 05:54 PM | #2518 | |

|

Captain

126

Rep 876

Posts |

Quote:

If SPX takes out 1365 then I agree with you and I would be wrong. |

|

|

Appreciate

0

|

| 01-19-2012, 07:46 PM | #2519 | |

|

Major

55

Rep 1,166

Posts |

Quote:

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

|

Appreciate

0

|

| 01-19-2012, 08:14 PM | #2520 | |

|

Private First Class

275

Rep 123

Posts |

Quote:

S&P just recorded entrance into some seriously over bought territory today. The question now becomes, how long it will stay there? If it stays there as long as we saw it in October, we will definitely hit 1365. However, SPX is forming a bearish wedge upwards right now with all the technical to support a breakdown rather than a break-out: entering high RSI and testing upper Bollinger bounds. Inversely, we have VIX entering a bullish wedge with the price continually being battered in too fast, with all the potential and technical supporting evidence of a breakout upwards to 26 levels. A pullback to 1250-1255 is most reasonable as that's where many short positions are camped and aiming for. Though, a break below 1240 would signify a potential to drop all the way to 1100. Around the 1100 level we have a lot of support, too much in fact that I fear we'd need an Armageddon to break through. They say nothing bad happens in an election year, with the stock market crashing only twice in all of election year's history. But those two crashes happened in the last 3 elections (2000 and 2008). I'm sure there's a lot of big interests out there who might crash the market before elections to ensure Obama doesn't get re-elected. Big Banks and Wall Street don't particularily like the Volcker Rule, Dodd-Frank, or new regulations on their derivatives markets. It's just costing them billions!  Just imo. And Republicans are all in favour of elimination income tax and repealing everything regulatory. None the less, 2012 is going to be interesting. Just imo. And Republicans are all in favour of elimination income tax and repealing everything regulatory. None the less, 2012 is going to be interesting. February we see the end of earnings seasons and edge towards March 20 where we might see a Greek default. April and beyond however, is where Q1 ends and all the bad data comes out "sobering" up this market. Might be the pivot point there. But I'm still expecting a pullback right now. Money is to be had (hopefully)!

__________________

|

|

|

Appreciate

0

|

| 01-20-2012, 02:25 AM | #2521 |

|

Lieutenant

646

Rep 568

Posts |

My top was supposed to come soon at around 131 so my bearish views are now gone for the time being and I'm back to neutral. If you look at the McClellan Osc, you would see an extremely high reading which IMO is a short term pull back.

Tomorrow is the Friday which is the most bearish weekday since the October 2011. Also according to Stock Trader’s Almanac, tomorrow, the January option expiration, is bearish too, Dow down 10 of last 13. If anyone believes in seasonality. |

|

Appreciate

0

|

| 01-20-2012, 03:32 AM | #2522 |

|

Private

0

Rep 59

Posts |

Trying to predict tops and bottoms is not a very good strategy. Going off historical data, news, and fundamentals in general tend to be unreliable indicators. The only way to make consistent gains in the markets, imho, is to really learn TA and then trade in the moment. Trade what you see, not what you want to see.

I now trade using only a few basic MAs and by plotting critical S/R. I believe this and a solid TA understanding is all the tools you need for the job. Of course you also have to set ground rules and stick by them no matter what. This is easier said then done. Once you develop this discipline however, watch for that momentum and ride that wave. |

|

Appreciate

0

|

| 01-20-2012, 02:30 PM | #2524 |

|

Private First Class

275

Rep 123

Posts |

Spx 5.3% above its closest 50dma, and reaching overbought territory. Of all the times we have entered overbought territory like this, the spx retraced on average -11%. And of all the times in the last two years where the spx has reached 5%+ above its own moving average, -10% retracement. Today we are seeing resistance at 1314. That would be 6-10 points away from our estimated tops of 1320-1330. Might be due now.

Thoughts guys?

__________________

|

|

Appreciate

0

|

| 01-20-2012, 02:36 PM | #2525 |

|

Major

60

Rep 1,097

Posts |

i think your right about the sobering brought on by Q1. If the market makes it that far it will certainly be the turning point, they have been touting numbers from December which we know isnt a good indicator, i would expect the worse. smart money will have shorted by then but the question will be how much will that leave in the market still bullish to be taken.

|

|

Appreciate

0

|

| 01-20-2012, 03:10 PM | #2526 | |

|

Lieutenant

646

Rep 568

Posts |

Quote:

|

|

|

Appreciate

0

|

| 01-20-2012, 03:21 PM | #2527 |

|

Major

55

Rep 1,166

Posts |

dont think so IMO looks to be like spx was going to correct it self today, but is getting pulled up by dow due to all the earnings released yesterday

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

|

Appreciate

0

|

| 01-20-2012, 03:42 PM | #2528 | |

|

Captain

29

Rep 769

Posts |

VIX has been low for quite a while so yeah I'd probably agree there will be some reversal soon (next week perhaps).

Quote:

__________________

|

|

|

Appreciate

0

|

| 01-20-2012, 04:27 PM | #2529 | ||

|

Private First Class

275

Rep 123

Posts |

Quote:

I also have taken a look at TVIX, which follows the VIX, and it's just had a Short-term KST oscillator go bullish (registered on 18th, but KST signals at end of the week on a friday or end of the month). For those who might not know KST oscillators, they are longer oscillations compared to MACD and generally considered much more accurate buy/sell signals. It's duration lasts 2-6 weeks as well. Makes me think February is when this will go for a full correction of about 10% to low 1200's. VIX set to pop to 26 levels, which as this point really is like 25%-30%. Should TVIX keep 2x gains, 50-60% rebound (potentially) for this month. 1365 looks a long ways away. They say IBM earnings held the DOW up today. I saw the impact and it contributed +60 points. Man... you know you have to run when 1 company is holding an entire index afloat.  Edit: Rally missing one thing: A Crowd. Quote:

__________________

Last edited by Vanity; 01-20-2012 at 05:18 PM.. |

||

|

Appreciate

0

|

| 01-20-2012, 05:13 PM | #2530 | ||

|

Major

55

Rep 1,166

Posts |

Quote:

__________________

2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game 2008 Monaco Blue 335i | Terracotta | Premium | Auto | Comfort Access | Matte-black Grills | Carbon Fiber Splitters | 20% Tint | 1- point E9x Picture Game  | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | | Staggered 19' VMR V701 | Legal Disclaimer: My posts on this website cannot be held against me in any issues, such as warranty claims. | |

||

|

Appreciate

0

|

Post Reply |

| Bookmarks |

|

|